Brex Just Sold for $5.15 Billion. Here's What That Actually Means

Nobody's talking about the other number. $12.3 billion. That's what Brex was worth in January 2022. Four years ago.

May 5, 2022. 7:56pm. Salad King restaurant, Toronto.

Not for failing. For chasing something that was never mine to begin with.

Five YC applications. Three interviews. Zero acceptances. Three years of my life optimizing for investors who never gave me a dollar.

27 years old. Immigrant from China. Building from Toronto since I was 17.

In 2017, I arrived at the University of Waterloo barely understanding how Canadian banks work.

But I was convinced I'd build the next big thing.

I devoured every YC video.

Every Paul Graham essay.

Every startup podcast.

I thought if I just followed the formula, I'd make it.

What I didn't realize:

The formula was written for someone else entirely.

2019-22

5 YC apps

0 accepts

2022

Rock bottom

$350K deal collapsed

2022

The pivot

$29 → $2K/mo

Now

$2.35M

Zero investors

The moment I stopped trying to raise VC and started charging clients directly, everything changed.

Read the full story in The Anti-Unicorn

The book behind this philosophy

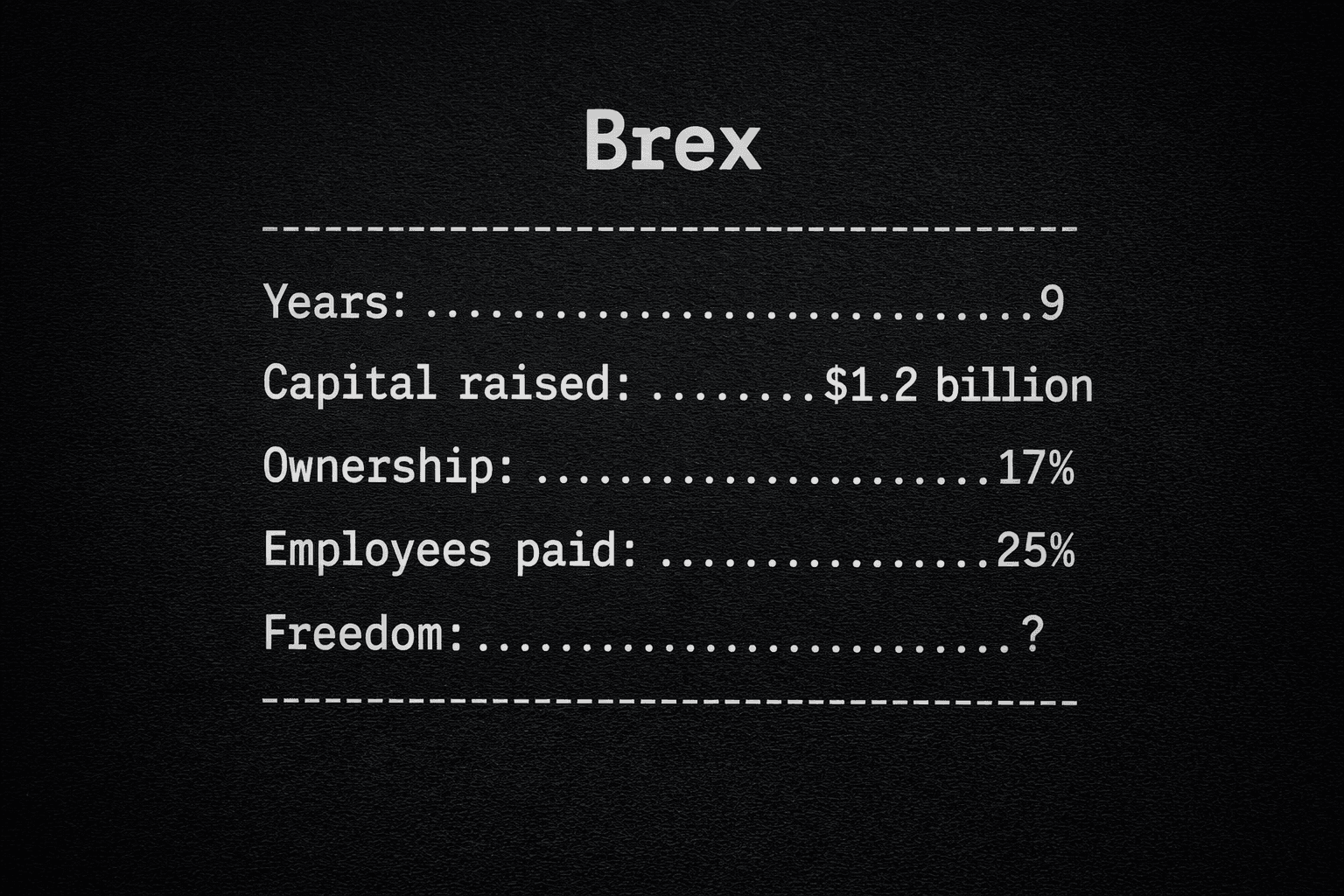

The math nobody showed me

of startups ever raise VC.

The path everyone optimizes for almost nobody gets.

Or...

10 clients × $10K/mo

= $1.2M/year

You keep 100%. Forever. No permission needed.

Two founders. Same 7 years. Different endings.

The "Successful" VC Founder

Top 25% outcome. Most do worse.

Your take-home after 7 years

$1.8M

$257K/year. Your senior engineer made more.

Divorced. Burned out. "Success story."

The "Boring" Bootstrap Founder

No TechCrunch. No Twitter clout.

Cash in bank after 7 years

$3-4M

Actual money. Not paper. No permission needed.

Still owns 100%. Still running. Still free.

The "failure" ends up 2× richer than the "success."

And nobody had to approve their vacation days.

So I stopped playing their game.

Founders who raised millions

raised

4 years. 80-hour weeks. Series A. Couldn't raise B.

Shut down. Founder got $0.

Me (zero investors)

cumulative revenue

Work when I want. Control everything. No permission needed.

The Anti-Unicorn Institution

8-week intensive. I personally help you build a profitable business you own 100%.

Your revenue

$10-50K/mo

Or a clear path there in 6 months. You keep 100%.

15-20 founders

Real-time, not recordings

No equity taken

$2.35M built this way

From zero to revenue

WEEK 1-2

Know exactly what to build

WEEK 3-4

90-day action plan ready

WEEK 5-6

First paying customers

WEEK 7-8

Repeatable revenue system

Every cohort, we select 2-5 exceptional founders for $0. Not scholarships — selection.

Exceptional. $0.

Strong fit. $5-20K.

Try next cohort.

75-80% rejection rate. I review every application personally.

If selected for a paid spot, choose your level of access.

Group-based intensive

Self-driven founders who thrive in groups

Details1:1 + group intensive

Complex situations needing 1:1 guidance

Details8 weeks. Real accountability. Keep 100%.

Nobody's talking about the other number. $12.3 billion. That's what Brex was worth in January 2022. Four years ago.

A few years ago I pitched a VC in Menlo Park. Their second-to-last question: "You're working on two companies at the same time. How does that work? Aren't you unfocused?" I explained one was an experiment while I spent most of my time on SimpleDirect. They passed. I could have taken ANC off my profile. I didn't. Other pitches, same question came up. Podcast appearances, same thing. "How do you stay focused?" The assumption behind the question: focus is good, optionality is bad. One thing, al

I got lied to a lot when I started. Took me years to realize that's just what happens when you're young, have money to spend, and can't tell the difference between confidence and competence. My BS detector needed training. The only way to train it was getting burned. The Education When networking was still a thing in my world, I'd go to events and meet people. Everyone looked impressive. Everyone had something to say. I had mentors who'd guide me. I believed everything they said. I didn't