Read this whole thing.

Not because I want your attention. Because you might be about to make a mistake that costs you the next decade of your life.

I've made that mistake. I've watched hundreds of people make it. I'm watching thousands more line up to make it right now.

Fifteen minutes. Then decide for yourself.

The Headline Everyone's Celebrating

Capital One just bought Brex for $5.15 billion.

If you're anywhere near tech, you've seen it. The LinkedIn posts. The Twitter congratulations.

"Incredible outcome."

"Henrique and Pedro crushed it."

"This is what winning looks like."

And look—part of me gets it. $5.15 billion is a big number. The founders are walking away with somewhere between $750 million and $1.25 billion combined.

That's life-changing money. That's never-worry-about-anything money.

But here's the thing.

Nobody's talking about the other number.

$12.3 billion.

That's what Brex was worth in January 2022. Four years ago.

They just sold for 58% less than that.

And somehow—somehow—everyone's calling this a win.

The Story

You're 23 years old. Just graduated from Stanford. Smart. Hungry. You've got that fire that tells you you're meant for something bigger.

You and your best friend have an idea. Corporate credit card that actually works for startups.

You apply to Y Combinator. You get in. Out of 27,000 applicants, you're one of the 260 they pick. Top 1%.

You feel like you've made it.

The next few years are a blur. You raise money. Then more money. Then more. Investors throwing cash at you. $57 million. $125 million. $425 million. $300 million more.

By 2022, you're worth $12.3 billion on paper.

Magazine covers. Conference stages. Your parents back in Brazil telling everyone about you.

You've made it.

Then the market turns. Growth slows. You make a bet on enterprise customers that doesn't pan out. You lay off hundreds of people. Your competitor Ramp starts eating your lunch.

The $12.3 billion valuation starts to feel like a joke.

Four years later, you're signing papers to sell your company—the thing you built from nothing, the thing you poured nine years into—for less than half of what it was worth.

Your "exit" is becoming an employee of Capital One.

This is the success story.

This is what you're chasing.

The Question

Brex isn't a failure. By any conventional measure, it's massive. Top 0.01% outcome. Founders are genuinely wealthy. Early investors made fortunes.

But I need you to ask yourself something uncomfortable.

Is this what you actually want?

Not what you think you should want. Not what your friends want. Not what Twitter tells you success looks like.

What do YOU actually want?

Because if the answer is "freedom"—if the answer is "control over my time"—if the answer is "enough money to never worry, plus the ability to do whatever I want"—

Brex is not the model.

Brex is a warning.

The Cap Table

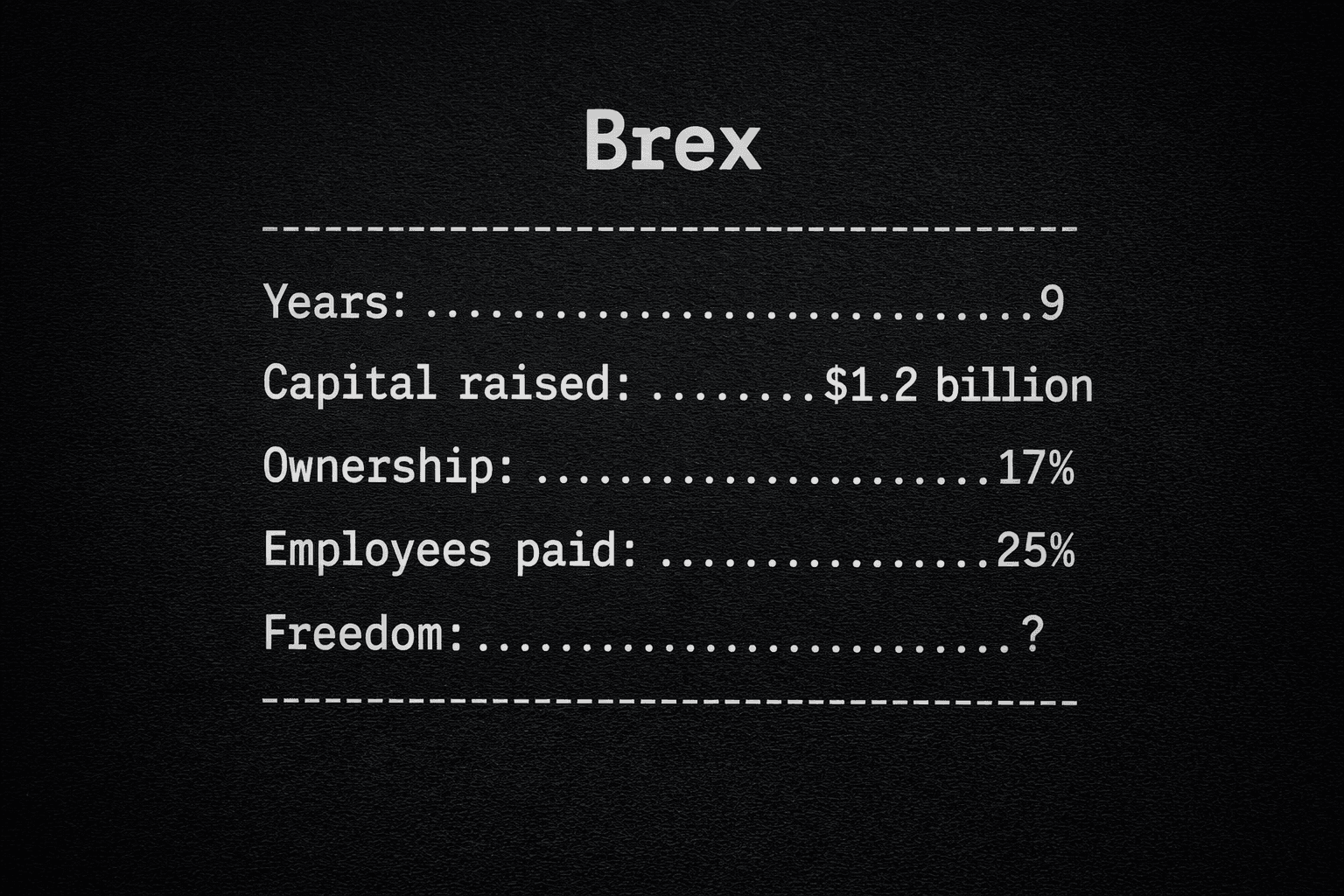

Numbers most people in tech don't want you to see.

Not because they're secret. Because they're inconvenient.

Brex raised approximately $1.2 billion over its lifetime.

When you raise that much, you give up a lot. Ownership. Control. Future upside.

Here's how the $5.15 billion sale probably breaks down:

Investors get paid first.

Liquidation preferences. They get their money back before anyone else sees a dime. Sometimes multiples of their money back.

After investors take their cut: $3.5-4 billion

Founders split what's left: $750 million - $1.25 billion combined

Employees get the scraps.

And here's where it gets ugly.

Brex was valued at $12.3 billion in early 2022. Anyone who joined after 2021—most of their employees, because that's when they scaled up—got their stock options priced at that valuation.

Strike price higher than sale price.

Options worthless.

75% of Brex employees will walk away from this "successful exit" with nothing.

Three out of four people.

Below-market salaries. Late nights. Missed soccer games. Belief.

Nothing.

And the founders? Rich, yes. But they own maybe 15-20% of the company they spent nine years building.

They just signed up to become employees of a bank.

The Lottery

Time to actually calculate the odds.

Not vague "it's hard." Real math.

Step 1: Get into Y Combinator

YC accepts about 1% of applicants. Recent batch: 260 companies out of 27,000+ applications.

0.96% acceptance rate.

Harder than Harvard. Harder than Stanford. Harder than MIT.

1% chance of even getting to the starting line.

Step 2: Don't Die

YC has a literal graveyard page on their website. Not making this up. Go look.

821 dead companies. About 20% of total portfolio.

But for older cohorts—ones with 10+ years to succeed or fail—death rate is closer to 40%.

Step 3: Don't Become a Zombie

Category nobody talks about.

Zombies. Technically alive. Some revenue. Some salaries. Going nowhere. No IPO coming. No acquisition coming. Just... existing.

Another 30-40% of YC companies.

Step 4: Become a Unicorn

Out of all YC companies ever, only 5-7% have become unicorns.

Best accelerator in the world. Best network. Best advice. Best odds.

5-7%.

Step 5: Exit at $5 Billion+

Brex didn't just become a unicorn. They exited at $5B+.

Maybe 10% of unicorns achieve that.

The Math

1% (get into YC) × 60% (don't die) × 50% (don't zombie) × 6% (unicorn) × 10% ($5B+ exit)

= 0.0018%

Roughly 1 in 55,000.

I'll be generous. Call it 1 in 20,000.

Those are your odds of becoming Brex.

And Brex is the success story we're celebrating.

What Should Make You Angry

YC knows these numbers. VCs know these numbers. Founders who've been through it know these numbers.

Nobody talks about them.

Instead, they show you the highlight reel.

Henrique and Pedro on stage. Glowing profiles. Congratulation tweets.

Thousands of smart people look at that and think: "That could be me."

The math says it almost certainly won't be.

Even at YC—absolute best-case scenario—roughly two-thirds of companies will never return meaningful money.

40% shut down completely.

Another 20-40% zombie.

5-7% become unicorns.

Small slice in the middle returns modest multiples.

Best accelerator in the world.

Your most likely outcome is still zero.

The Question That Changed Everything

Five years ago, I was you.

Applied to YC five times. Rejected five times.

Each rejection felt like a door closing. Like I wasn't good enough. Like I was missing the only path that mattered.

I watched friends get in. Watched them raise. Watched their faces on TechCrunch.

Felt like a failure.

Until one day I asked myself:

"What do I actually want my life to look like in ten years?"

Not "what does success look like." Not "what would impress people." Not "what's the biggest outcome I could achieve."

What do I WANT?

Got really honest. Answer wasn't "run a billion-dollar company."

It was:

- Wake up without an alarm

- Work on things I choose

- Enough money to never worry

- Own my time completely

- Report to no one—not investors, not a board, not a boss

That's freedom.

And here's what I realized:

The path everyone told me to follow—YC, VC, "scale at all costs"—was optimized for the exact opposite of what I wanted.

Two Paths

Path #1: You "Win" the Startup Lottery

You beat the 1-in-20,000 odds. You build the next Brex.

Takes nine years. 80-hour weeks. Missed births, weddings, funerals. Health gone. Relationships gone. Twenties and thirties gone.

Raise over a billion dollars. Board to report to. Investors emailing at midnight. Employees depending on you. Customers threatening to leave.

Can't sell when you want. Can't pivot when you want. Can't quit when you want.

After almost a decade, you finally get your exit.

Own 15% of the company.

Sells for half of what it was worth at peak.

Walk away with $400-600 million after taxes.

Your "reward"? You now work for Capital One.

That's winning.

Path #2: You Build Something You Own

Don't play the lottery. Find 10 clients who pay you $10,000 a month for something you're good at.

Takes two years. Maybe three.

$100,000 a month. $1.2 million a year.

Keep 100%.

No investors. No board. No liquidation preferences.

Work 20-25 hours a week. Fridays off. Travel when you want. Say no to clients you don't like.

After ten years, you've made $10-12 million.

Not $500 million. But here's the thing:

You owned every minute of those ten years.

Weren't waiting for an exit. Weren't hoping the market would cooperate. Weren't praying your board wouldn't fire you.

You were free.

The whole time.

"But That's Not Exciting"

I know what you're thinking.

"$1.2 million a year is nice, but it's not 'change the world' money."

"I want to build something that matters."

"I want to be someone."

If you're finding this useful, I send essays like this 2-3x per week.

·No spam

Had those thoughts too.

But who told you bigger is better?

Who told you your worth is determined by your valuation?

Who told you "success" means sacrificing a decade for a 1-in-20,000 shot at becoming an employee of a bank?

Was it you? Or was it the ecosystem that profits from your belief?

Here's what I've learned:

VCs need you to believe scale is everything. Their model depends on it. They're playing portfolio theory.

If 1 in 50 bets returns 100x, they win. The other 49 can go to zero—doesn't matter to them.

But it matters to you.

You're not a portfolio. You're one person with one life.

And you've been convinced to play a game where the house almost always wins.

The Ramp Comparison

Something interesting.

Ramp is Brex's biggest competitor. Same thing—corporate cards and spend management.

Two months after the Brex acquisition was announced, Ramp raised at $13 billion valuation.

Almost 3x what Brex sold for.

Both raised about $1 billion total. Great teams. YC pedigree.

But Ramp made different decisions.

Stayed more focused. More capital-efficient. Didn't make the bet on enterprise that nearly killed Brex.

Now? Ramp's founders probably still own 25-30% of a $13 billion company.

Brex's founders own 15-20% of a $5 billion company.

Same starting point. Same resources. Dramatically different outcomes.

The lesson isn't "be more like Ramp." The lesson is that even when you do everything "right," the path you've been sold is wildly uncertain.

The Counterfactual

I keep running this thought experiment.

What if Brex had raised $50 million instead of $1.2 billion?

Sounds crazy. $50 million doesn't build a "billion-dollar company," right?

Stay with me.

At $50 million raised, founders probably keep 65-70% instead of 15-20%.

Grow slower. More focused. Don't make the insane enterprise bet that backfired.

Maybe still build a great business. Maybe worth $2-3 billion instead of $5 billion.

But at 65% ownership of $2.5 billion?

$1.6 billion.

Versus 17% ownership of $5.15 billion?

$875 million.

The "smaller" outcome would have made them almost twice as rich.

And they'd still have control. Could choose to sell or not. Choose their acquirer. Choose to keep building.

Choice is the asset. Control is the wealth.

They traded both away for the privilege of raising a billion dollars.

What You Actually Need

Secret the startup ecosystem doesn't want you to know:

You don't need $5 billion to be free.

Don't even need $5 million.

You need $30,000-50,000 a month in income you control.

That's it.

At $40K/month:

- $480,000/year income

- No boss

- No board

- No investors over your shoulder

- Ability to say "no" to anything

- Time for people you love

- Energy for things that matter

- Sleep

That's freedom.

And the path to $40K/month you control is infinitely more achievable than becoming Brex.

The Math That Actually Works

You have skills. If you're reading this, if you've worked in tech or business for a few years, you have skills worth money to the right people.

Product strategy. Engineering. Marketing. Sales. Operations. Something.

Step 1: Find your $5K skill

What can you do that a business would pay $5,000/month for?

Not one-time project. $5,000/month ongoing.

It exists. I promise.

Step 2: Find 5 clients

Not 500. Not 50. Five.

Five people or companies with a problem you can solve, who have money.

Takes most people 6-12 months while still working their day job.

Step 3: You now make $25,000/month

$300,000/year.

You keep all of it.

Step 4: Optimize

Raise rates. Add clients. Build small team. Create leverage.

$25K becomes $40K becomes $75K becomes $100K.

Not theoretical. I've done it. Watched dozens do it.

Not easy. But not a 1-in-20,000 lottery either.

The Real Risk Calculation

People say the "safe" path is a job at a big company.

People say the "risky" path is starting something on your own.

Different framing.

The "safe" path:

- Trade time for money

- No control over income

- Can be laid off any time

- Building someone else's equity

- AI coming for your job

- One income stream that can disappear tomorrow

The ownership path:

- Build income you control

- Multiple clients = no single point of failure

- Skills compound in your own business

- Own 100% of what you create

- Small and nimble = can adapt to anything

- Antifragile

Tell me again which one is "risky."

My Story

Applied to YC five times. Rejected five times.

For years, thought that was my biggest failure.

Now I think it might be the best thing that ever happened to me.

Forced me to find another way.

Couldn't play the VC game. So I built something small. Something I own completely.

No investors. No board. No permission required.

I'm 27. Work about 20 hours a week. Multiple businesses I own 100% of. Don't report to anyone.

Not a billionaire. Not on magazine covers.

But I'm free.

And I don't work for Capital One.

The Decision

Every day spent chasing the wrong dream is a day you don't spend building real freedom.

Every year optimizing for someone else's definition of success is a year you lose.

You don't get those years back.

Not trying to scare you. Trying to wake you up.

Because the thing they don't tell you about the startup lottery:

Even when you win, you might lose.

Even when you beat the 1-in-20,000 odds, you might end up with less money, less freedom, and less control than if you'd just built something small that you owned.

Brex proves it.

So What Now?

You made it this far. That tells me something.

You're not the type to just accept what everyone accepts.

Not the type to chase a dream without questioning whether it's really yours.

Not the type to play a game without understanding the odds.

Now you have a choice.

Option A: Close this tab. Go back to LinkedIn/X. Keep optimizing for a 1-in-20,000 lottery. Hope you're the exception.

Option B: Ask yourself what you actually want. Start building toward that. Today.

Can't make the choice for you.

But I can tell you this:

Five years from now, you're going to be somewhere.

Either five years closer to freedom.

Or five years deeper into a game that was never designed for you to win.

Clock's ticking.

One Last Thing

If this resonated—if something here made you think differently—I want to help.

Not because I'm selling something.

Because I was you.

Chasing the wrong dream. Optimizing for the wrong metrics. Playing a game I didn't understand.

Someone showed me a different path.

Trying to do the same for you.

Everything I know is free. YouTube. Newsletter. All of it.

Start there.

Or if you want to move faster—structure, accountability, a room full of people building the same thing—Freedom is an 8-week intensive for people who want to build something they own 100%.

No VC. No lottery. Just real freedom.

Either way, stop waiting.

Best day to start was five years ago.

Second best day is today.

George Pu builds and invests in businesses from Toronto. He works about 20 hours a week. He does not work for Capital One.

P.S. — Know someone who needs to read this? Someone about to spend the next decade chasing the wrong dream? Send it to them.

-1754757174784.jpg&w=128&q=75)