$300K

Three years ago I was running custom algorithms.

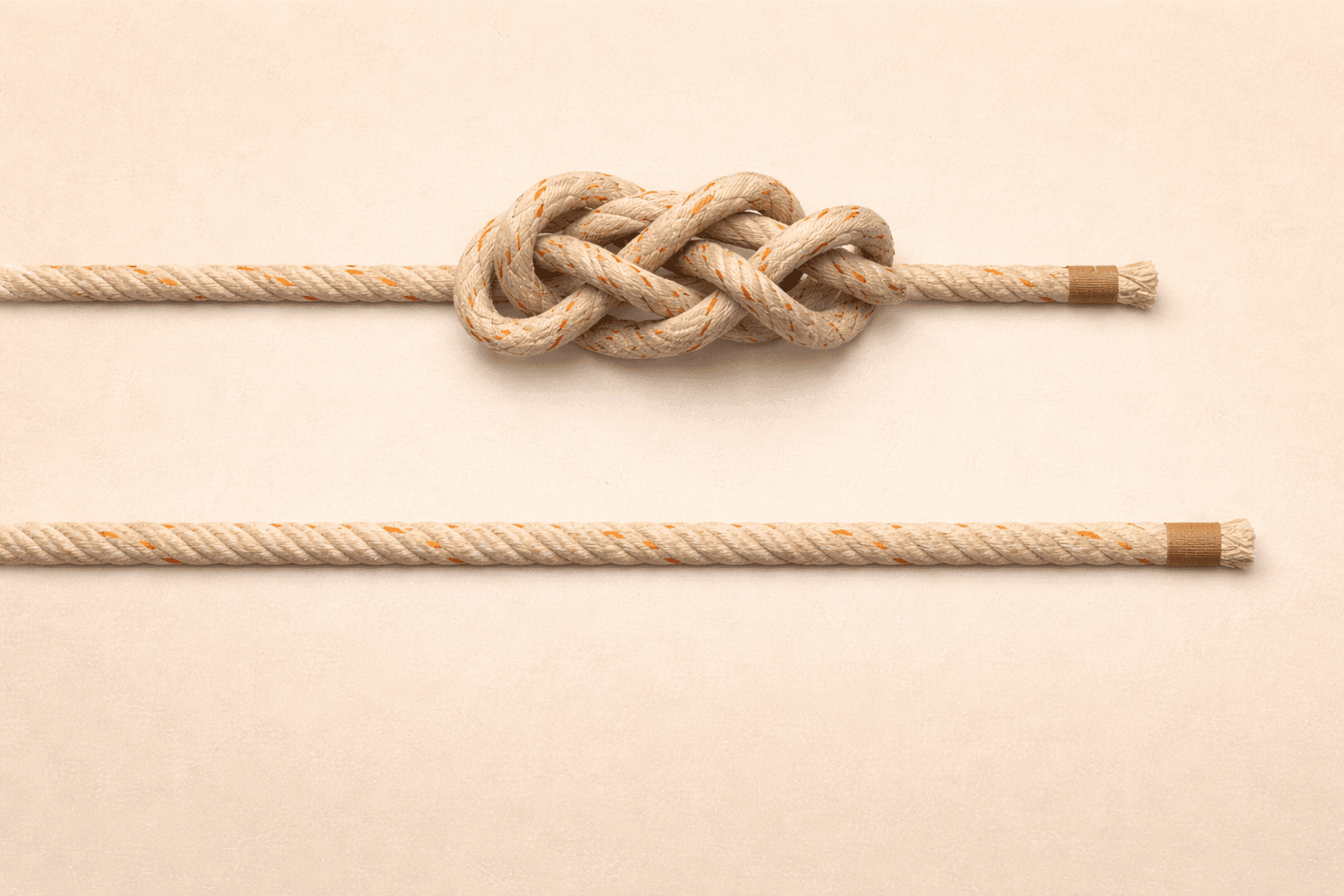

Backtests. Models. "Edges." The whole thing.

I'd stare at charts for hours. Convinced I'd figured something out. Convinced I was smarter than the market.

I wasn't.

$300K gone. A house down payment. Evaporated trying to be clever.

The Pivot

If I'd just bought VOO and done literally nothing, I'd have made money AND had my time back.

That's not a metaphor. I did the math. The boring approach would have beaten me by a lot.

So I stopped.

Sold everything. Bought index funds. Berkshire. A couple small positions. Set it up to auto-update. Stopped looking.

Live Data

Today I'm making that portfolio public.

Live data. Pulled directly from my brokerage. Every position. Every transaction. Every dollar.

Not screenshots I can edit. Actual numbers that update automatically.

Here's the link: founderreality.com/investing

Underperforming

Right now I'm underperforming the S&P 500 by about 5%.

Six months of data. Noise.

The strategy is 30 years, not 30 weeks. If I'm still underperforming in 2035, you can laugh at me then.

The Rules

The rules are simple:

I'm not smarter than the market. No edge. Accept it.

Time in beats timing. Buy when I have money. Never sell.

Boredom is the strategy. Feel nothing. Emotion is the enemy.

Fees are theft. Near-zero only. No advisors.

Check it less. Quarterly at most. Looking means temptation.

My edge is elsewhere. Build businesses. That's my alpha.

Why Public

Here's why I'm sharing this.

Everyone talks about investing philosophy. Almost nobody shows the actual numbers.

I wanted to build something I could point to in 10 years. 20 years. 30 years.

Either the boring approach works, or it doesn't. We'll find out together.

No hiding. No editing history. Just the numbers, updating live, for decades.

The Challenge

The page has a challenge at the bottom.

Sign up and I'll email you once a year with my performance. Compare it to yours.

You with your trades, your timing, your conviction picks.

Me with my boring index funds and Berkshire shares, doing nothing.

Let's see who wins.

The Reminder

I think about those three years a lot.

1000+ hours staring at charts. The stress. The dopamine hits. The crashes.

All for negative $300K.

Now I spend maybe 30 minutes a quarter on this. Buy something boring. Close the app. Go build businesses.

That's where my edge actually is.

The portfolio just needs to not lose money while I focus on things I can control.

Check it out if you want: founderreality.com/investing

Or don't. It's mostly for me.

A reminder of what happens when I try to be smart.