I'm 27. I've spent three years afraid to write this post.

Not because I don't believe it. Because I was terrified of what the cult would do. The Twitter pile-ons. The "have fun staying poor" responses.

The being permanently labeled as a hater who "doesn't understand Bitcoin."

But "Own or Be Owned" includes owning your mind. So here we are.

The Narrative Collapse

Gold just hit all-time highs. Bitcoin is down 40% from its peak. When I point this out to Bitcoin maximalists, they have a fascinating response: "Bitcoin is better than gold because it's limited."

Gold is also limited. Gold is also portable. Gold never needed a power grid.

The "digital gold" narrative has completely collapsed. It wasn't investment thesis. It was marketing.

When your story stops working, cults don't abandon the story. They just rewrite it. Bitcoin isn't about gold anymore.

It's about "adoption." It's about "institutions." It's about "the next cycle." Every variation points the same direction: "buy more."

How I Know This

I'm going to use Dr. Steven Hassan's BITE Model. Hassan spent decades studying cults - the BITE acronym stands for Behavior, Information, Thought, and Emotional control.

It's not conspiracy theorizing. It's a framework used by cult deprogrammers.

Let me walk through it.

Behavior Control.

Bitcoin maximalists have scripts. "Stack sats." "Go 100% in." "Never sell." "HODL" isn't a strategy - it's a command disguised as a meme.

The language itself prevents exit. Selling = "paper hands." Selling = weakness. Selling = losing. The community ostracizes anyone who leaves.

I've watched people tell me they sold Bitcoin and immediately get shamed by their friend groups. That's behavioral isolation. That's cult behavior.

Information Control.

Mainstream economists? Shills. Financial advisors? Threatened by the revolution. Bloomberg? FUD.

Anything that contradicts the thesis is automatically enemy propaganda. The only trusted sources are Bitcoin Twitter, specific podcasts, specific substacks.

You're living in an information silo the size of El Salvador.

When every outside perspective is filtered through "they don't understand," you've created an unfalsifiable system. They either understand Bitcoin or they're ignorant. There's no third option.

Thought Control.

This is the creepiest part. The Bitcoin thesis is constructed to be unfalsifiable.

Price goes up? "It was the right call."

Price goes down? "They're accumulating." Bad regulation? "Test of conviction." Good regulation? "Adoption accelerating." Up down left right—every outcome confirms the thesis.

That's not investing. That's religion.

Emotional Control.

"Have fun staying poor" isn't trash talk. It's psychological manipulation.

It's shame. It's painting non-belief as stupidity, cowardice, or being left behind. Missing out on Bitcoin is reframed as the greatest mistake of your life.

Now you're emotionally invested in being right. Doubt becomes anxiety. Not buying becomes regret you haven't felt yet.

The Financial Engine

Michael Saylor owns 714,000 Bitcoin (as of early Feb 2026). That's about 3.4% of all Bitcoin in existence.

When Saylor tells you to stack sats, he's literally pumping his asset. Every new buyer that enters the market based on his content increases his net worth.

If you're finding this useful, I send essays like this 2-3x per week.

·No spam

He has a financial incentive to sound like he's revealing truth. He's just funding his position.

The same is true for every major Bitcoin influencer. They own millions. They tell you what to buy. You buy. Their asset goes up. Then they become more famous. Then more people listen. Then more people buy.

It's not a pyramid scheme technically. But the structure rewards the people at the top for recruiting the people at the bottom.

If I owned 713,000 Bitcoin, I could write a 10,000-word thread on why Bitcoin is the future. I could hire the best designer to make it go viral. I could buy podcast sponsorships. And every single word would technically be true. It would also be conveniently profitable.

That's not a conspiracy. That's just aligned incentives.

Why I'm Writing This

I'm writing this because I'm watching young developers get recruited into this. Not recruited into an investment. Into a belief system.

I watch engineers on Twitter get told that real freedom means going 100% Bitcoin and rejecting fiat entirely. That working for a company is slavery unless you're being paid in sats. That owning a home or a business is copper-brained thinking.

These are brilliant people. And they're being told that doubt is weakness.

I watch them stop reading about financial diversification. Stop thinking about tax-advantaged accounts. Stop questioning because questioning gets you labeled as not understanding the vision.

That's not freedom. That's a cage made of certainty.

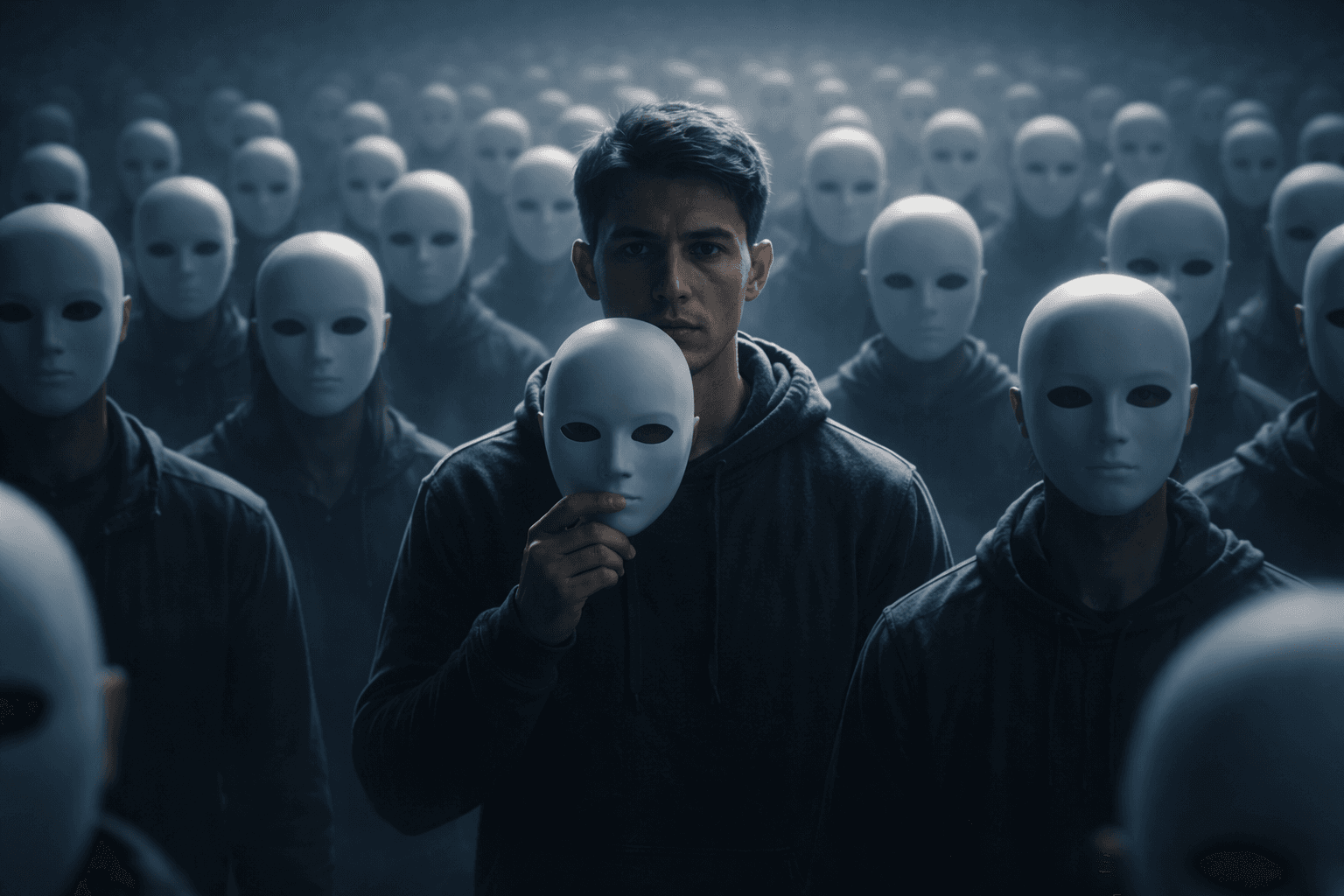

The people inside feel liberated because they've surrendered the work of thinking. Cults feel good on the inside. That's the whole problem.

What I Actually Believe

I don't think Bitcoin is worthless. I think it's an interesting asset with real technical properties and real believers. That's not nothing.

But I think the maximalist movement around Bitcoin has become cult behavior. I think the marketing has outpaced the fundamentals.

I think enormous leverage and psychological manipulation are being used to convince young people that this is their only path to freedom.

And I think freedom that requires you to believe unfalsifiable things and shame people who disagree isn't freedom at all.

The hardest part of owning yourself? Being willing to change your mind when you're wrong. Being willing to admit doubt. Being willing to disagree with your community.

That's the test. That's what separates someone who thinks for themselves from someone who just found a louder echo chamber.

The Fear

I'm publishing this knowing I'll get attacked. I'll get called poor, uneducated, threatened with "you'll see in the next cycle." The response will probably prove my point about emotional control, which is darkly funny.

But here's what I know: I sleep well. My businesses provided value people wanted. My money is diversified. I'm not dependent on the price of any one asset to feel like I'm winning.

That's not because I'm smarter than Bitcoin maximalists. It's because I decided early that my identity wasn't allowed to be fused with my portfolio.

And I hope some of you reading this who've felt that cognitive dissonance—that voice inside saying "wait, this doesn't add up"—I hope you listen to it.

Your mind is the only asset you're actually born with. Everything else is infrastructure.

-1754757174784.jpg&w=128&q=75)