Why 99.95% of founders are playing a game they can't win—and what to do instead

I was 19 years old when I realized I'd been sold a lie.

Not by bad people. Not by scammers.

But by an entire industry that had convinced me—and millions of other founders—that there was only one way to build a successful startup.

Raise venture capital. Move to San Francisco. Scale fast. Exit big.

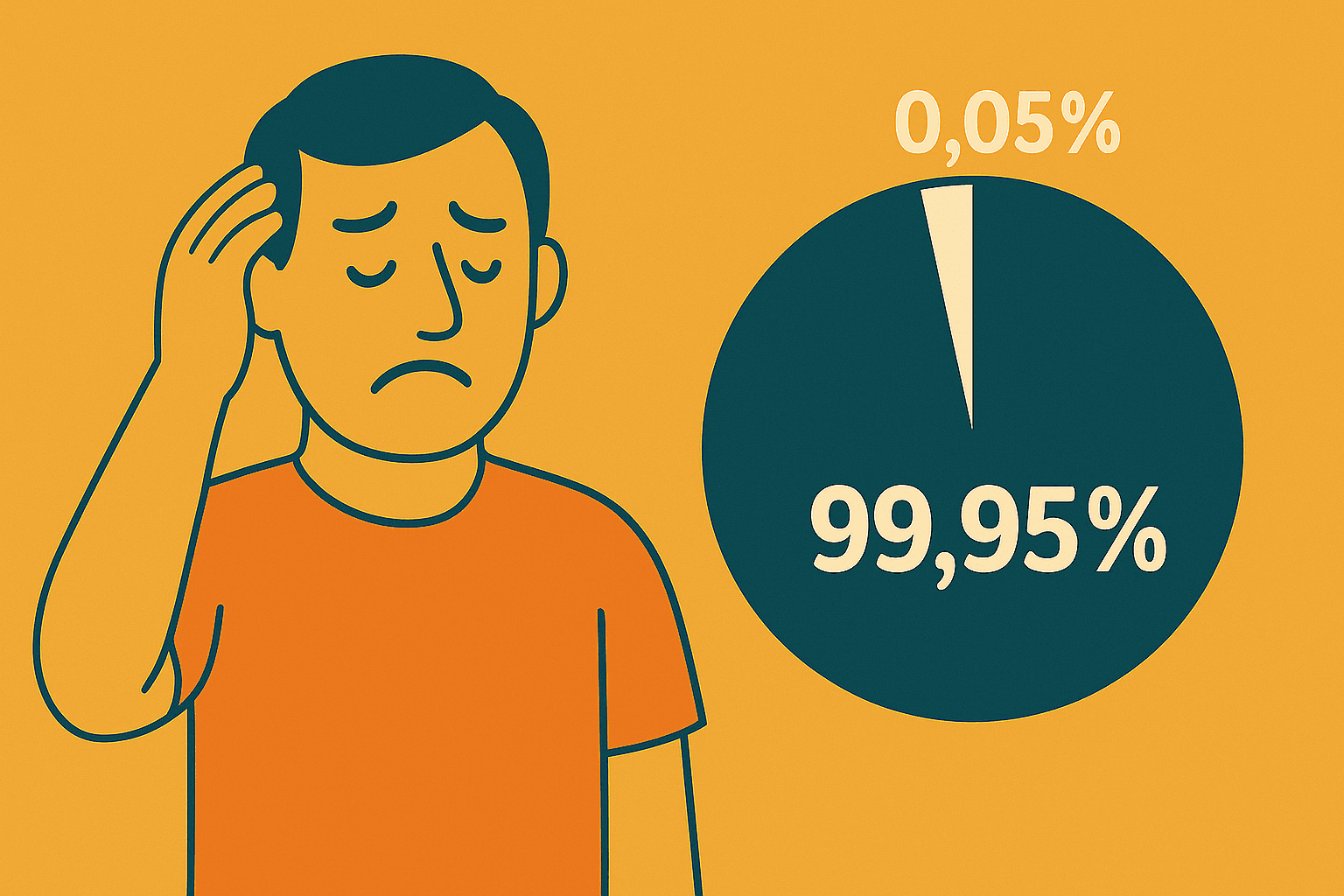

The problem? The math doesn't work for 99.95% of us.

Let me show you the numbers they don't put in the TechCrunch headlines.

The 0.05% You Never Hear About

Here's the stat that should be on every aspiring founder's wall:

Only 0.05% of startups ever raise venture capital.

That's not a typo. Five in 10,000.

According to Fundera, DemandSage, and Lighter Capital—multiple independent sources converge on the same number: 0.05%.

Everyone else? They bootstrap. They take bank loans. They borrow from friends and family. They figure it out.

But when you're scrolling Twitter or reading founder blogs, it seems like everyone is raising millions.

That's survivorship bias at its finest—you only see the winners because the losers don't write Medium posts.

The VC-backed founders get the press. The bootstrapped founders get the profits.

Even If You Raise VC, You'll Probably Fail

Here's where it gets worse.

Let's say you're one of the lucky 0.05% who actually raises venture funding. Congratulations—you beat 99.95% of founders just to get in the door.

Now you have a 75% chance of failing anyway.

According to Harvard Business School research by Shikhar Ghosh:

- 75% of venture-backed companies never return cash to investors

- 30-40% of those completely liquidate (investors lose everything)

- Only 25% return any capital

- Only 10% generate significant returns

Let that sink in. Even if you're in the elite 0.05% that raises VC, you still have a 75% failure rate.

The odds are worse than roulette.

The Y Combinator Lottery

"But what about Y Combinator?" you ask. "Surely YC companies have better odds?"

Let's look at the data.

Y Combinator has funded approximately 5,000 companies since 2005. Their portfolio includes some of the biggest success stories in tech: Airbnb ($75B), Stripe ($95B), DoorDash ($50B).

They're wildly successful at what they do.

But here's what the numbers actually show:

- ~50 YC companies became unicorns (1%)

- ~500 reached $10M+ in revenue (10%)

- The remaining 4,450 companies (89%) either failed or became what YC considers "disappointments"

YC themselves admit this in their own materials: "We expect 1-2 companies per batch to become billion-dollar companies."

Each batch is 200-400 companies.

Do the math: 1-2 out of 300 = 0.3-0.6% unicorn rate per batch.

Even at the world's most prestigious startup accelerator, your odds of building a unicorn are less than 1%.

Top VCs Reject 99.3% of Applications

Think you can just apply to a top VC and get funded?

Marc Andreessen himself disclosed that Andreessen Horowitz sees about 4,000 applications per year. They review around 3,000. They fund about 20.

That's a 0.5% acceptance rate at one of the most active VCs in the world.

Compare that to Harvard's acceptance rate (3.4%) or Stanford's (3.7%). Getting into a16z is 7x harder than getting into Harvard.

And remember: even among those 20 funded companies, only 2-3 will return meaningful capital to the fund.

Geography Is Everything (And You're Probably in the Wrong Place)

Here's the stat that made me realize the game was rigged from the start:

75% of US venture capital goes to just three metro areas:

- San Francisco Bay Area (45% of all VC dollars)

- New York (18%)

- Boston (12%)

If you're not in one of those three cities, you're fighting for scraps.

The math gets even worse:

- San Francisco receives 45% of VC funding with only 8% of the US population

- Per capita VC investment in SF: $15,000 per person

- Per capita VC investment in the rest of the US: $600 per person

That's a 25x difference based purely on geography.

And if you're in Canada like me? Only 2-3% of North American VC flows north of the border, mostly to Toronto and Vancouver.

Waterloo? Kitchener? Calgary? You're invisible.

Your business could be incredible. Your team could be world-class. Your traction could be undeniable.

But if you're not in the right zip code, you don't exist to VCs.

The Alternative Path They Don't Talk About

Here's what nobody tells you:

If you're finding this useful, I send essays like this 2-3x per week.

·No spam

Bootstrapped companies have a 70-80% survival rate.

According to the U.S. Small Business Administration, 80% of small businesses without VC funding survive past 5 years—compared to a 25% survival rate for VC-backed startups.

The Fundable.com study found that bootstrapped companies are 2x more likely to reach profitability than VC-backed ones.

Guidant Financial's 2023 research showed that 73% of small businesses are profitable, versus 25% of VC-backed startups.

Let me repeat that: Your odds of success increase from 25% to 73% when you optimize for profit instead of unicorn exits.

The path is less glamorous. You won't be on TechCrunch. You won't ring the NASDAQ bell.

But you'll own 100% of your company. You'll be profitable from year one. You'll build on your own terms.

Why I'm Telling You This

I wasted years chasing the VC dream.

I was in Waterloo. On a student visa. Building SimpleDirect—what I thought would be the next Stripe for home improvement financing.

I read all the right books. I followed all the advice. I built a product.

What I didn't have was access.

No warm intro to Sequoia. No network in the Valley. No Stanford pedigree. No Y Combinator batch.

I thought I wasn't good enough.

It took me years to realize: I wasn't playing the wrong game. I was just playing their game.

The VC model works for VCs. It works for the 0.05% who have access. It works for the 1% who achieve unicorn status.

It doesn't work for the other 99%.

And that's okay—because there's a better way.

The Revenue-First Alternative

Over the past six years, I've built three profitable businesses from Toronto:

- SimpleDirect (BNPL infrastructure for home improvement)

- ANC Startup School (consulting for international student founders)

- ANC Ventures (AI-first venture studio)

Zero VC funding. Zero board pressure. 100% ownership.

I've helped dozens of founders at ANC do the same thing: build profitable, sustainable businesses without giving up equity or control.

The playbook is simple:

- Consulting first → Validates customer problems with real paying customers

- Revenue first → Proves business viability before building product

- Bootstrap first → Maintains control and eliminates burnout risk

- Geographic independence → Build from anywhere with internet

This isn't theory. This is how 37signals, Mailchimp, GitHub, Atlassian, and countless others built billion-dollar businesses—without VC in the early days.

What This Means For You

If you're reading this and feeling like you're "not good enough" to raise VC, let me reframe that:

You're not playing the wrong game. You're being sold the wrong definition of success.

The question isn't "Can I raise VC?"

The question is: "Can customers pay me real money right now?"

If the answer is yes, you don't need permission from Sand Hill Road.

The Path Forward

In my upcoming book The Anti-Unicorn, I break down exactly how to build this way:

- How to find your first customers in 30 days

- How to charge $2K-$5K monthly from day one

- How to transition from consulting to product

- How to build a $10M+ business with no funding

But you don't need to wait for the book.

You can start today.

Stop optimizing for pitch decks. Start optimizing for customers.

Stop chasing VC validation. Start chasing revenue validation.

Stop playing their game. Start building yours.

Next up: In the next article, I'll break down the actual VC fund economics—and show you why even the "winners" aren't really winning the way you think they are.

Want Chapter 1 of The Anti-Unicorn for free? Download the full chapter that expands on these statistics and shows you the exact alternative path that works:

George Pu is the founder of ANC Ventures and author of The Anti-Unicorn: How the 99% Build Real Businesses Without VC Permission. He's built three profitable companies from Toronto without raising venture capital.

-1754757174784.jpg&w=128&q=75)